- Solar energy blog

- What is LCOE and why is it important?

What is LCOE and why is it important?

Laura Rodríguez

Territory Manager Oceania & Nordics

Laura is a renewable and software industry sales professional, currently working at RatedPower as Territory Manager Oceania & Nordics. With a background in International Business and International Trade, Laura previously worked in the business strategy area in various companies as well as as a market analyst for the Government of Spain in Australia.

Content

The decision to invest in an energy project depends not just on whether it’s viable, but on the profitability that it’s likely to achieve over its lifespan. The way to determine that is by assessing a few key financial metrics, including the levelized cost of energy (LCOE).

Also known as the levelized cost of electricity or the levelized energy cost (LEC), LCOE calculates the cost not only of building a project, but also of operating and maintaining it over time.

LCOE explained

The LCOE is the lifetime cost of an electricity plant, divided by the amount of electricity it is expected to generate over its lifetime.

By calculating the cost of generating electricity throughout the lifespan of the plant, the LCOE tells you the average cost per unit generated. It also indicates the average minimum price at which the electricity must be sold for the project to break even and cover the cost of production.

The LCOE includes the capital cost of constructing the project, the price of fuel, operational and maintenance costs, as well as decommissioning costs. LCOE amounts to the average price that the electricity the plant generates must be sold at to reach a net present value (NPV) of zero, assuming a constant price for the project’s lifespan.

If the LCOE is lower than the electricity price the plant can achieve, the project can potentially turn a profit. If the LCOE is higher than the electricity price, the project will likely be unprofitable.

Why is LCOE important?

LCOE is a useful metric as it enables comparisons between different projects and energy sources to determine which is the most competitive.

The calculation allows project developers and financiers to make an apples-to-apples comparison between generation technologies such as solar, wind, nuclear, gas, and coal, taking into account different project lifespans, capital costs, fuel costs, capacity size, and risk.

Understanding the LCOE of a renewable project is key to demonstrating how it competes with fossil fuel generation.

LCOE of non-renewable vs renewable energy production

The cost of nuclear power generation has risen over the past 10 years, while the cost of coal-fired generation has stabilized and the cost of gas-fired electricity has fallen. But at the same time, the cost of solar photovoltaic (PV) generation has plummeted by 89% and wind power has dropped by 70%, as equipment costs have fallen. This is because wind turbine manufacturers have developed larger turbine blades with higher capacity, solar PV manufacturers have increased panel efficiencies, and manufacturers have increased their production efficiencies.

The cost of traditional fossil fuel and nuclear plants depends largely on prices for gas, coal, or nuclear fuel, as well as operations and maintenance (O&M) costs. Renewable installations tend to have lower O&M costs, and they do not have any fuel costs. As sunlight and wind are free sources of energy, the cost of renewable systems depends on the cost of the technology. Improved inverter reliability, remote monitoring technologies, and new innovations in solar panel cleaning have reduced solar maintenance costs in recent years.

What does this mean for LCOE? It means that gas- and coal-fired projects need to be able to sell their electricity at a higher price than solar or wind projects to break even, and ultimately, become profitable.

Renewable systems no longer require large subsidies to offset the cost of expensive equipment. By reaching grid parity in many places, they can compete directly with conventional generation plants without government financial or policy assistance.

The current energy crisis that has driven up oil and gas prices has only made renewables even more attractive from an LCOE perspective. The LCOE of oil and gas plants has risen, while the LCOE of renewable energy has been unaffected. Higher electricity prices, therefore, generate higher profits for renewable generators than for fossil fuel generators that have to cover higher fuel costs.

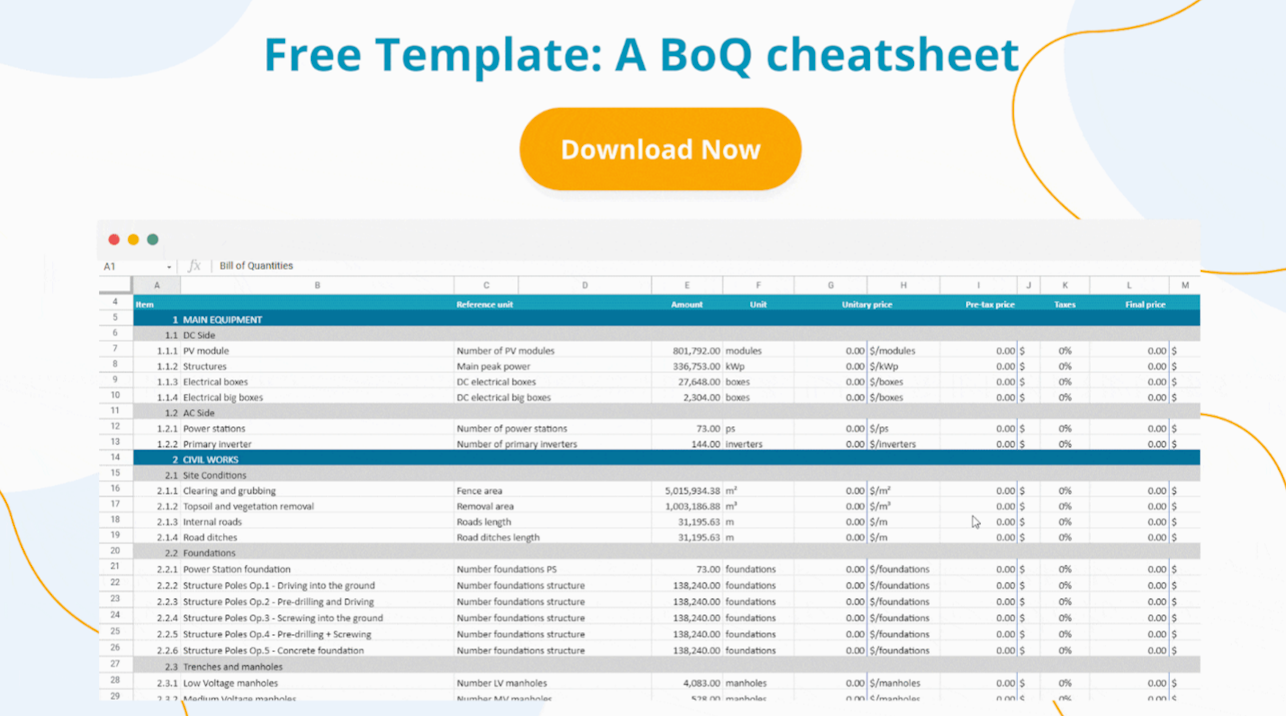

Get your solar power plant costs on track! Understand how the different equipment quantities and prices affect LCOE with a real case scenario. Download it now!

How to calculate LCOE

Now that you understand why LCOE is so important for evaluating a project, how do you calculate it?

The LCOE formula divides the NPV of the total cost of building and running the plant by the NPV of the electricity output it is forecast to generate over its lifespan.

The total cost will include figures for the initial capital outlay, O&M costs, and fuel costs (if any). It will also take into account the discount rate of the project and any subsidies or tax incentives. The output refers to the total amount of electricity the plant is expected to generate over its lifetime. The average operational life of a solar energy system is around 25 years.

As a simple example of an LCOE for a solar PV system:

Initial capital cost: $50,000

Tax credit: $15,000

O&M: $4,000

Total cost: $39,000

Average annual electricity production: 62,500kWh

PV equipment warranty period: 25 years

Total electricity production: 1,562,500kWh

LCOE: $39,000 / 1,562,500 = $0.02496/kWh

If the electricity generated can be sold for more than $0.02496/kWh, then the project can be profitable. But if the price for electricity is less than $0.02496/kWh, the project’s revenue would not cover the cost and it would lose money over the 25-year period.

Calculating the LCOE can help developers size a renewable project to generate enough electricity over its lifespan to break even. It can also identify whether a project can make cost savings or it is too expensive to become viable.

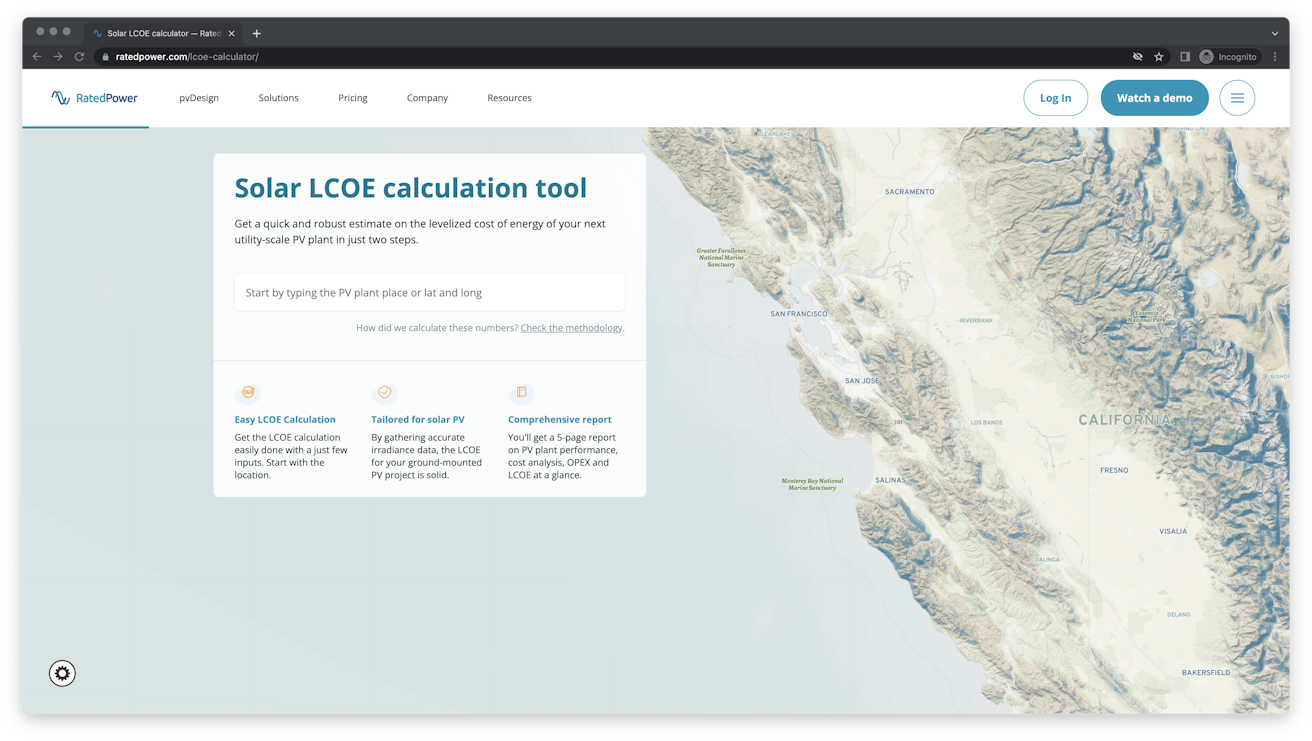

Get a quick and robust estimate on the levelized cost of energy of your next utility-scale PV plant in just two steps. Take a look at our Solar LCOE calculator!

RatedPower automates project finance analysis

Financial metrics such as the LCOE are essential components of project analysis and can help you to determine whether a proposed solar PV system is viable as well as how it compares with other renewable or fossil fuel projects. As solar technologies have reached grid parity in many places around the world, this can make the case for adding new clean energy capacity over building a new polluting fossil fuel plant.

RatedPower automates the design and analysis of solar PV projects, including the calculation of LCOE. Contact us to find out how to optimize your project development.

Free BoQ template: Get your solar power plant costs on track

Having your PV plant costs on track is a hard task. Reduce the hassle with this comprehensive template with with 70+ items.

Latest stories

Related posts

Policy and regulation

Public tenders reshape Central America and Caribbean energy markets

Discover how Central America and the Caribbean are accelerating their energy transitions through large-scale public tenders and legislative reforms.

Updated 10 MAR, 26

Market analysis

A look at the largest-scale solar projects across the UK

Find out more about how the UK is developing substantial solar power projects, including the Queequeg Renewables Solar PV Park and the Botley West Solar Farm.

Updated 24 FEB, 26

Market analysis

Battery Storage in Africa: From Backup to Backbone

See why Africa is prioritizing off-grid battery storage that operates independently, as 50% of its population doesn’t have access to a stable power supply.

Updated 19 FEB, 26

- RatedPower

- Solar energy blog

- What is LCOE and why is it important?

Watch a demo

Watch a demo