- Solar energy blog

- Solar energy in Sub-Saharan Africa: 5 trends driving the growth

Solar energy in Sub-Saharan Africa: 5 trends driving the growth

Laura Rodríguez

Business developer

Laura is a renewable and software industry sales professional, currently working at RatedPower as Sales Overlay in North America & Territory Manager Oceania. With a background in International Business and International Trade, Laura previously worked in the business strategy area in various companies as well as as a market analyst for the Government of Spain in Australia.

Content

African nations are accelerating their use of renewable power generation as increasing urbanization, population growth, and economic development are driving electricity demand and governments look to improve access to affordable energy.

The falling cost of solar energy systems is encouraging the adoption of the technology across sub-Saharan Africa, as a way to leapfrog straight to low-carbon, sustainable solutions.

There are several key trends emerging in the industry as the region builds its solar capacity. Here are five of them.

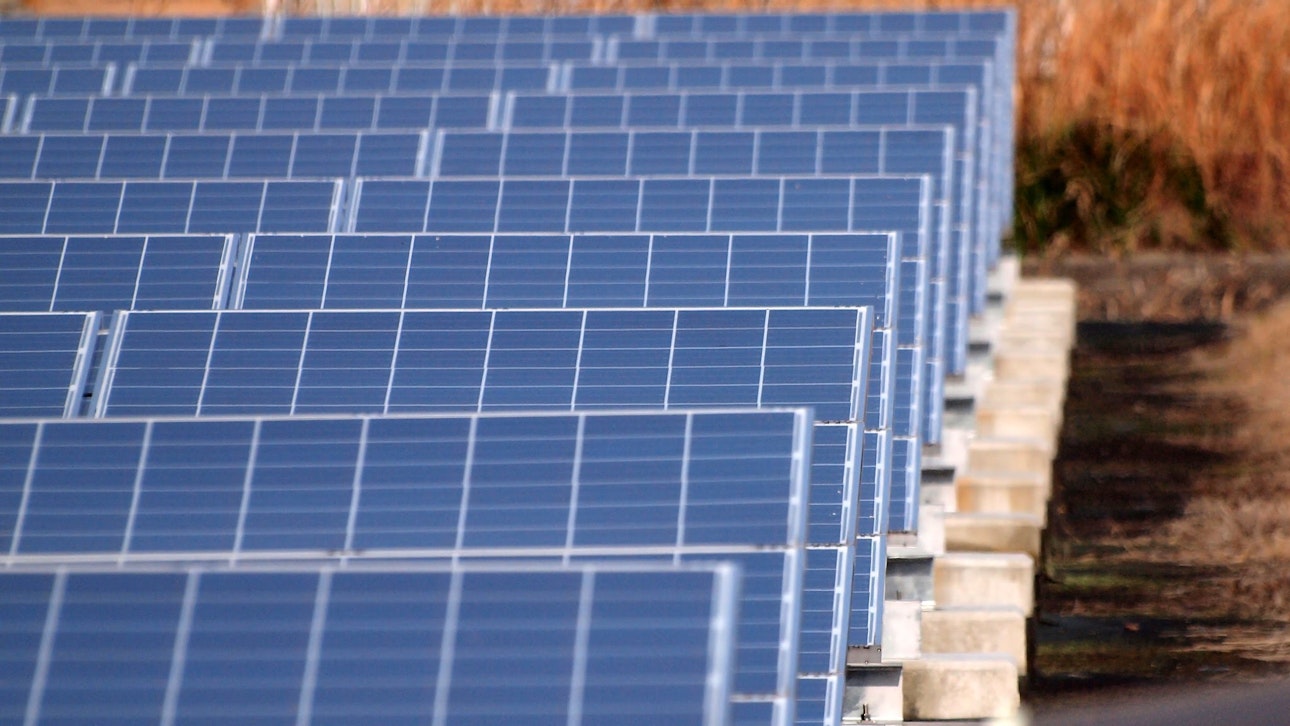

Booming utility-scale projects

June 2021 saw an unprecedented 1.88GW of large-scale solar projects commissioned, awarded, or confirmed, according to the Africa Solar Industry Association (AFSIA).

There are eight countries in sub-Saharan Africa that will soon join South Africa in surpassing more than 1GW of solar capacity:

Zimbabwe

Zambia

Democratic Republic of Congo (DRC)

Angola

Namibia

Ethiopia

Botswana

Nigeria

AFSIA has identified more than 7,600 projects, with more than 1,000 already operational.

The largest project announced in June was a South African tender for 540MW of solar photovoltaic (PV) and 1,140MWh of battery storage awarded to Norwegian renewable power producer Scatec. The first-of-its-kind Risk Mitigation tender aims to ease recurring power shortages in the country by providing a source of dispatchable power.

In Zambia, the construction of the 200MW Serenje PV plant is due to start in September and take 15-18 months to be completed. The plant will send the electricity it generates to the national grid.

Do you want to be up to date with the renewable energy industry? This eBook is perfect for you: "What’s in store for this year: Renewable Energy and Solar Research Report". Download it now, it's free!

Off-grid systems to increase access

With national power grids undersupplied in many countries in the region, the market for off-grid solar installations is growing rapidly. The sharp fall in the cost of equipment, coinciding with the rollout of mobile banking and affordable financing in Africa’s fastest-growing economies, is allowing households to lease solar panels on a pay-as-you-go basis.

Off-grid solar systems provider Azuri Technologies estimates that over 5 million African households have pay-as-you-go off-grid systems. It offers a range of appliances such as TVs, radios, satellite entertainment and Internet access to bring digital technology to off-grid households. Azuri, which operates in Kenya, Tanzania, Uganda, Zambia, and Nigeria, has sold more than 200,000 systems since 2012.

In addition, off-grid generation resolves the constraints of limited grid capacity, which in some areas has hampered the rollout of renewable energy. Off-grid solutions, particularly community projects, are key to providing electricity to underserved communities while bypassing the limitations of underdeveloped power grids.

UK-based consulting firm Kleos Advisory estimates that the African off-grid solar market could present a commercial opportunity of around $24 billion annually.

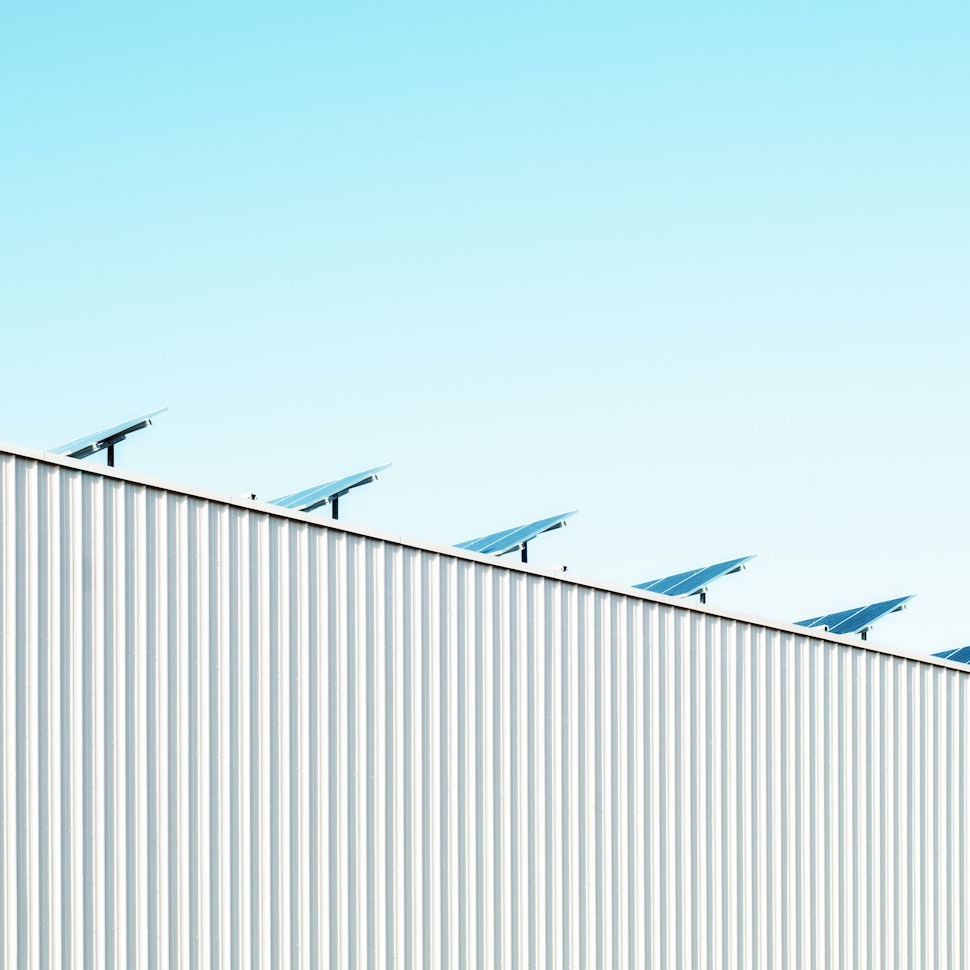

Rooftop installations

The increase in blackouts as industrial and household demand grows and the decline in costs is creating opportunities for the growth of rooftop solar. Mordor Intelligence expects the rooftop solar market in South Africa to expand at a compound annual growth rate (CAGR) of more than 9.5% up to 2026, for example.

In late 2020, Botswana became one of the first African countries to launch a net metering and feed-in tariff scheme, the AFSIA said. The Rooftop Solar Program will allow for 8MW of commercial and industrial capacity and 2MW of residential in its first year, with the threshold expected to increase in the coming years. Grid electricity prices increased after the launch, which is encouraging more electricity users to consider installing solar.

The regulator in Botswana also awarded a license to an independent power producer for the first time, permitting Shumba Energy to build 100MW of capacity to sell to the grid.

Foreign investment

Africa’s vast renewable resources make it an attractive destination for international investment. Overseas companies invested more than $34.7 billion in the continent’s renewables sector from 2011 until the end of 2020, according to research by global law firm Linklaters. More than $20 billion was invested in solar and more than $12 billion in wind power. France, the UK, Italy, the US, and Spain were the top five sources of investment.

World leaders at the G7 Summit in June pledged to invest more than $80 billion in the private sector in Africa over the next five years, focusing on renewable energy – including off-grid pay-as-you-go systems – along with infrastructure, manufacturing, agriculture, and technology.

In countries like DRC, Zambia, and South Africa, international mining companies are increasingly investing in solar power and storage installations to ensure the availability of low-cost electricity for their sites as supply tightens.

The rise of solar storage

Just as the lower cost of solar equipment has made it more viable for widespread rollout in Africa, falling costs for battery storage systems are also encouraging adoption. Some of the world’s largest solar panel manufacturers, such as JinkoSolar and Huawei, are offering packages that combine storage solutions with their solar modules and inverters.

JinkoSolar said in June it is delivering a 1.2MWh energy storage system to an unnamed customer in West Africa, one of its first storage projects on this scale using DC coupling to efficiently supply energy to the power grid. The company sees further opportunities in Africa as the relatively poor state of power grid infrastructure and high electricity prices create the potential to replace peaking gas and coal plants with dispatchable solar and storage systems.

In some places, companies are expanding solar systems with additional panels and adding batteries, while new projects are incorporating batteries from the outset. Green Yellow Madagascar is expanding the capacity of its Ambatolampy 20MW solar installation that was commissioned in 2018, doubling it to 40MW, and adding 5MWh of battery storage which it plans to commission by the end of the year. Green Yellow Madagascar is a joint venture between French renewable power company GreenYellow and African industry group Axian.

In Mozambique, construction has started at the Cuamba solar plant, which will combine 19MW of PV capacity with 7MWh of battery storage. Independent power producer Globeleq will sell power from the installation to utility Electricidade de Moçambique (EDM) under a 25-year power purchase agreement (PPA).

In Somaliland, Germany microgrid technology provider DHYBRID has installed the country’s largest battery system, with 2MWh of storage and 8MW of solar capacity to help increase grid stability and reduce costs.

Plan your next solar power project

The acceleration of the energy transition is presenting more investment opportunities in underserved regions like Africa, where there are clear advantages to the adoption of solar.

If you are planning a solar power project, RatedPower can help you to optimize the design for the most efficient installation. Contact us to find out how.

Latest stories

Related posts

Technology and engineering

Innovation in renewable energy: Developments expected in 2025

We look at the 10 biggest renewable industry developments that are making a green future possible, including perovskite solar cells, green hydrogen, and more.

Updated 18 MAR, 25

Market analysis

Breaking down solar farm costs: Free template inside

Updated 27 SEP, 21

Market analysis

Solar energy in Australia: a 2021 market analysis

Updated 11 MAY, 21

- RatedPower

- Solar energy blog

- Solar energy in Sub-Saharan Africa: 5 trends driving the growth