- Solar energy blog

- How Southeast Asia is driving the solar energy sector: 5 trends to watch out for

How Southeast Asia is driving the solar energy sector: 5 trends to watch out for

Laura Rodríguez

Business developer

Laura is a renewable and software industry sales professional, currently working at RatedPower as Sales Overlay in North America & Territory Manager Oceania. With a background in International Business and International Trade, Laura previously worked in the business strategy area in various companies as well as as a market analyst for the Government of Spain in Australia.

Content

Countries in Southeast Asia are accelerating the rate at which they deploy renewable energy capacity, as they seek to achieve full access to affordable, clean electricity for all their citizens.

Economic growth in the Association of Southeast Asian Nations (ASEAN) region is expected to increase residential electricity demand to 497.1TWh by 2040, which is almost double the level of demand seen in 2017, according to the 6th ASEAN Energy Outlook.

The goal of the second phase of the ASEAN Plan of Action for Energy Cooperation (APAEC) 2021-2025 is to reach a 35% share of renewable generation in installed power capacity by 2025. That would require the deployment of around 35-40GW during that period.

The highest growth rate is expected to come from solar, with a compound annual growth rate of 10.4% from 2018 to 2040, according to the ASEAN Energy Outlook.

So, what are some of the ways countries in the region are working to meet their targets?

Are you into renewable trends? You can't miss our report on the solar and renewable energy trends to follow in 2023. Download it today for free!

Vietnam takes the lead in solar

The south-east Asia region is projected to nearly triple its installed solar capacity to 35.8GW by 2024, according to consultants at Wood Mackenzie.

Vietnam, Thailand, the Philippines, and Malaysia account for around 98% of the solar capacity in the region. Vietnam vaulted into the lead in 2020, installing a massive 9GW of rooftop solar – around 6GW of that in December – as developers secured feed-in tariffs (FiTs) before they expired at the end of the year. With another 1GW of ground-mounted solar capacity installed during the year, Vietnam has become the world’s sixth-largest solar market, with a total capacity of 16.5GW at the end of 2020, according to the International Renewable Energy Association (IRENA).

In November, Southeast Asia’s largest solar plant started operation in Vietnam – the 273MW phase I of the Xuan Thien Ea Sup project in Dak Lak. The project will scale up to 2.8GW by early 2022.

However, the rate of new installations in the country is expected to slow in 2021, as the government has yet to introduce the next phase of FiTs. The new rate is expected to be substantially lower, as the power grid has yet to catch up with the rapid pace of renewable installation. However, over the long term, the government expects to continue increasing solar capacity, reaching 20GW by 2030.

Installing floating solar panels

Southeast Asian nations, such as Indonesia, are looking to floating solar panels as a way to cope with monsoon flooding. What’s most impressive about floating installations is that they can withstand extreme weather conditions like typhoons, large waves, and high winds.

ASEAN’s floating solar capacity is rising quickly, from just 1MW in 2019 to several hundred megawatts thanks to a slew of large projects. Indonesia started a project in May 2021 to install a 145MW floating solar farm at the Cirata Lake hydropower reservoir in West Java, the first in the country and the largest in the region. The project is expected to be completed in late 2022.

This month, a 60MW floating solar farm opened in Singapore, where the government plans to quadruple its solar capacity by 2025. Floating solar panels are one way for the nation to add capacity while addressing its land scarcity. In Thailand, there are several projects planned with capacity of 45-55MW.

And, in Malaysia, a 60MW installation will become the largest floating solar project in the country after a 13MW site came online in October 2020. And in the Philippines, there are plans for a 110MW floating solar farm on Laguna Lake.

Diversifying away from hydropower

Previously, Southeast Asia’s renewable energy industry focused mainly on hydropower. Laos exports around half of the power it generates, most of which comes from hydropower. The government plans to increase the country’s hydropower generation to become the “battery of Asia”.

But at the same time, the impact of climate change is increasing the severity of droughts in the region. While Laos is a net electricity exporter, there are certain times in the year when it must import. In response, the government has started to award contracts for solar power.

The first utility-scale solar project, with a capacity of 76MW, is scheduled to start operation in the fourth quarter of this year. And Vietnamese firm Wealth Power Group is joining local partners to build two solar farms, one with a capacity of 500MW and the other 80MW.

Small-scale community solar projects are also bringing electricity to remote villages that are not connected to the power grid.

Neighboring Cambodia has put a hold on two hydropower projects because of low river levels. Its 10-year energy plan focuses on installing solar capacity along with coal plants. The government has approved plans for 300MW of solar and expects to add more capacity each year from 2021.

Introducing new renewable energy laws

Several countries in Southeast Asia are in the process of introducing new energy laws and renewable policies to support the adoption of wind and solar.

Indonesia is planning to pass a new renewable energy law, carbon tax, and FiT policy in 2021. The government is targeting a 23% renewable energy mix by 2025, up from around 9% in 2020, which would require around 10GW of additional capacity.

The Philippines is in the process of finalizing its National Renewable Energy Program for 2040. Under the draft plan, the government is setting a target for the country to increase its share of renewables from 29% in 2019 to at least 35% by 2030 and more than 50% by 2040. The country has halted the construction of new coal power plants since October 2020.

In Vietnam, the government is drafting the National Power Development Plan 8 (PDP8) for 2021-2030, along with the new FiT. The plan calls for the gradual phase-out of coal in favor of renewable energy.

Increasing large-scale installations

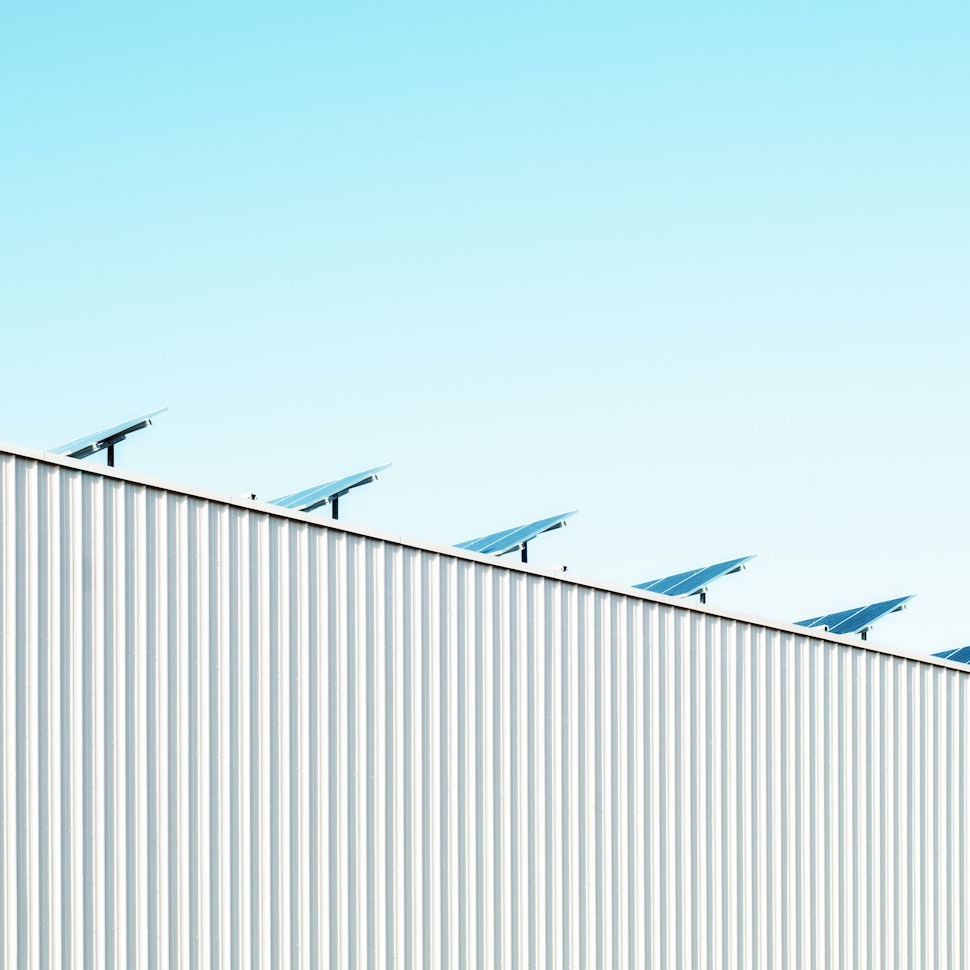

As Southeast Asia solar capacity has started to ramp up, developers have started to commission larger-scale projects. Around 83% of the solar projects commissioned in the region in 2021 are expected to be larger than 100MW, up from around 68% last year and 32% in 2019.

Vietnam’s bumper solar development has seen projects of around 500MW come into operation. And in June last year, Malaysia issued a tender for 1GW of solar capacity under its Large Scale Solar (LSS) procurement program.

In the Philippines, AC Energy brought its 120MW Gigasol Alaminos solar project online in June, the second-largest solar installation in the country. It had already added 183MW of solar capacity earlier in the year and has another 276MW of renewable capacity under construction in the country, which it plans to double by the end of the year.

Plus, Japanese company Mitsui is developing a 115MW solar project in the Philippines with Global Business Power, an independent power producer.

Plan your solar project with RatedPower

If you are planning a solar power installation anywhere in the world, RatedPower can help you optimize the project. Contact us for a demonstration of our platform.

Latest stories

Related posts

Technology and engineering

Solar Power Technologies that rocked it in 2022

28 Oct, 21 | Updated 14 Nov, 22

Technology and engineering

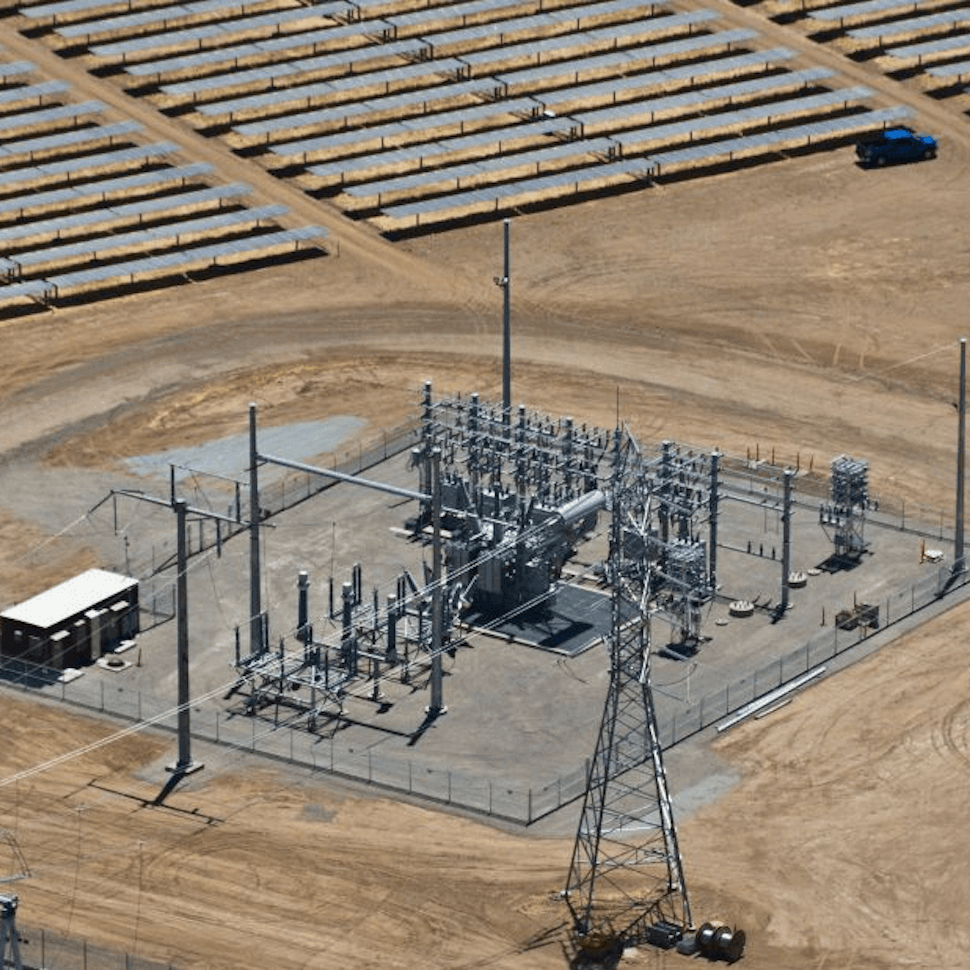

Learn PV substation engineering and design automation with RatedPower

Do you know why and how a solar farm connects to the grid? RatedPower automatically generates the best solution for an interconnection facility and chooses between a switching and breaking station, a line to transformer substation or a single/double busbar substations.

2 Dec, 21

Market analysis

Breaking down solar farm costs: Free template inside

4 May, 21 | Updated 27 Sep, 21

- RatedPower

- Solar energy blog

- How Southeast Asia is driving the solar energy sector: 5 trends to watch out for